- News & Information

- Press Releases

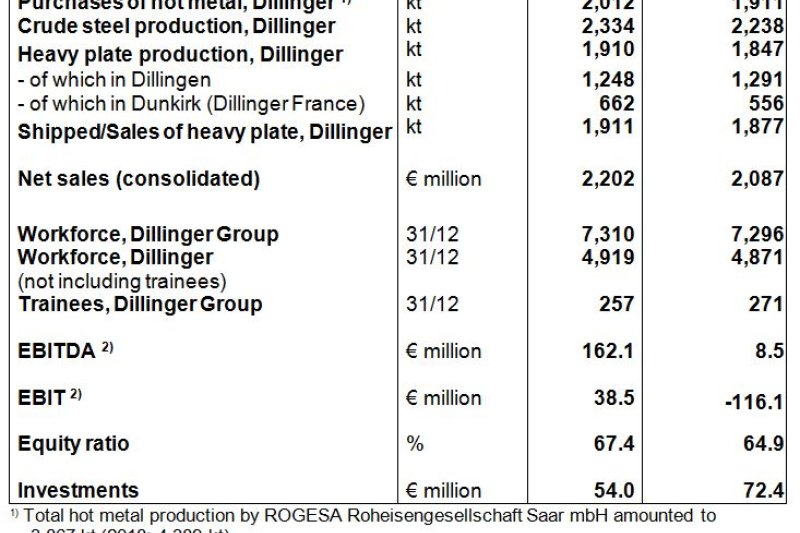

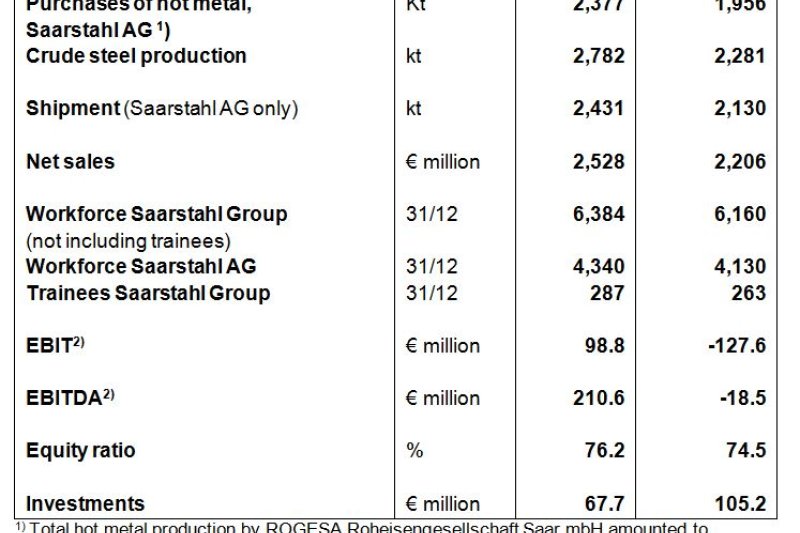

Key figures for the 2019 financial year for Dillinger Group and Saarstahl Group

24. March 2020

Annual press conference 2020

- Very difficult market conditions led to weaker demand

- Net sales fell accordingly: by 5.2% to €2.087 billion in the Dillinger Group and by 12.7% to €2.206 billion in the Saarstahl Group

- Dillinger Group closed the financial year with an EBITDA of €8.5 million and an EBIT of -€116.1 million / Saarstahl Group recorded an EBITDA of -€18.5 million and an EBIT of -€127.6 million

- The equity ratios of Saarstahl (74.5%) and Dillinger (64.9%) are proof of the financial structure remains solid

- Joint strategy process “proactive, carbon-free, efficient” will continue to be advanced

- Goals have been clearly defined: cost reductions of €250 million and an earnings contribution of €150 million from sales activities

- Outlook for 2020 with major uncertainties

The Dillinger Group (Aktien-Gesellschaft der Dillinger Hüttenwerke [Dillinger] with its subsidiaries) and the Saarstahl Group (Saarstahl AG [Saarstahl] with subsidiaries) experienced a very difficult 2019 financial year. In addition to weakening economic conditions, the structural circumstances continued to pose a major challenge for the entire European steel industry: increasing protectionism and associated tariffs are making the products of European steel producers more expensive; there are still global overcapacities and the EU steel market continues to suffer due to high imports, despite the introduction of safeguard measures aimed at curbing trade diversion.

Tim Hartmann, Chairman of the Board and CFO of Saarstahl and Dillinger, commented on the 2019 financial year at the first joint annual press conference for both groups of companies: “We have been severely impacted by the structural and cyclical problems in the steel market. The results fell short of our expectations. In addition to the decline in volumes and revenues, this is also due to weaknesses in our cost structure. Significantly higher raw material procurement prices, including cost burdens from carbon emissions certificate trading, also had a negative impact. Earnings have been additionally burdened by provisions for planned restructuring measures. With the consistent implementation of our ‘proactive, carbon-free, efficient’ program for the future, we defined clear goals in 2019 in order to be sustainably profitable and to successfully shape the transformation to carbon-neutral production of our steel.”

And Hartmann continued: “The growth targets in sales are 100% backed with measures and are integrated into the three-year plan for the medium term. Initial successes have already been achieved here, including entry into the rail market.

The savings potentials that have so far been backed with measures represent over 75% of the overall cost targets set and indicate for us the opportunities we have. Now we must begin the implementation. The current coronavirus crisis will delay the process in parts. We are sticking to our targets. We want the most modern steel industry to be here in Saarland.”

The situation in the market for wire and rod and for heavy plate remained very strained in 2019. The companies were severely strained economically by declining demand and upheavals in key customer segments such as the automotive and machine manufacturing industries. As a result, Saarstahl has been operating with short-time work schedules since September. Dillinger was able to benefit in 2019 from very good demand in individual areas during the first three quarters. The pipe plate market remained under strong pressure throughout the year. As a result, Dillinger too was forced to introduce short-time work schedules in January and February 2020.

Markedly negative results – investments remain high

Net sales of the Saarstahl Group fell by 12.7% to €2.206 billion (previous year: €2.528 billion). The consolidated EBITDA (earnings before interest, taxes, depreciation and amortization) of the Saarstahl Group amounted to -€18.5 million (2018: €210.6 million) and the consolidated EBIT, i.e. earnings before interest and taxes, to -€127.6 million (2018: €98.8 million). Investments in the Saarstahl Group amounted to €105.2 million (2018: €67.7 million). The most significant investment was the construction of the new S1 continuous caster, which was completed at the end of 2019. With this investment, Saarstahl is thus once again setting the benchmark for product quality and customer service in the long products sector.

Net sales of the Dillinger Group decreased by 5.2% to €2.087 billion (previous year: €2.201 billion). The consolidated EBITDA (earnings before interest, taxes, depreciation and amortization) of the Dillinger Group amounted to €8.5 million (2018: €162.1 million) and the consolidated EBIT, i.e. earnings before interest and taxes, to -€116.1 million (2018: €38.5 million). Investments in the Dillinger Group amounted to €72.4 million (2018: €54 million). The majority of investments went into measures to improve environmental protection at ROGESA's Dillingen site – such as the first use of hydrogen as a reducing agent in the blast furnace.

In addition, provisions for the planned restructuring measures were made in both groups of companies.

Outlook for 2020

The forecasts for the 2020 financial year currently underway are subject to significant challenges and uncertainties. The spread of the coronavirus has noticeably intensified the already high uncertainty. The associated negative effects on the economy as a whole and on our companies are currently difficult to predict, but all indications are they will be severe. In addition, the challenging market conditions at the beginning of 2020 – overcapacities, import pressure, economic downturn in our core customer segments – will continue and are currently making it difficult for both companies to maintain good capacity utilization and to significantly raise prices. Demand is expected to pick up in the second half of the year.

Strategy process in implementation

As part of the strategy process, the “proactive, carbon-free, efficient" program for the future was launched in 2019 with the aim of increasing profitability. A contribution to earnings of €150 million from sales activities has already been budgeted as a result of a proactive realignment of the business strategy.

With regard to savings in material costs, more than 80% of the defined target of €150 million has already been backed with concrete measures. Personnel measures to fulfill the intergenerational contract amount to €100 million, 75% of which has already been provided.

“There is no alternative to the €100 million savings in personnel measures and we must think beyond the days of the current coronavirus crisis,” says Peter Schweda, Chief Human Resources Officer and Labor Director. "Thanks to socially compatible instruments, some of which are new, the cost program will be implemented without compulsory redundancies. We expect to see the first effects in 2020, even if the coronavirus crisis that is affecting us all considerably delays the process. We are in an exceptional situation due to COVID-19, but everything we have planned for the preservation of the steel industry remains correct.”

And Tim Hartmann added: “The collective strategy process that has been initiated for Dillinger and Saarstahl serves to develop us further worldwide in line with the needs of our customers and to consistently tap new growth potential. We want to position ourselves with our products in promising new business areas and thus contribute meaningfully to the important future issues of energy transition and mobility. Steel is the material of the future and we and our employees want this steel to be produced in the Saar region in the state-of-the-art steel industry.”

Carbon-neutral production is feasible

Within the strategy process, the conversion to carbon-neutral production is a central issue. Measures are already being implemented (coke gas injection with hydrogen being used for the first time as a reducing agent). Additional steps such as bridge technologies and concrete technological options are being analyzed and assessed in terms of their metallurgy and economics and preparations for them are being studied. Dillinger and Saarstahl are clearly committed to the Paris Climate Agreement and the goals formulated therein. Our studies show that transformation is feasible but will cost billions and require the necessary political and social support.

The first hurdle on the way to carbon-neutral production has now been cleared politically. The Steel Action Plan – drafted by Germany’s Federal Ministry of Economics, the management boards of the major steel companies, the German Steel Federation (WV Stahl) and representatives of IG Metall – is the first document with concrete implementation measures for securing a strong, internationally competitive and climate-friendly steel industry in Germany. “But this is only an intermediate step. We need the commitment of the entire federal government. The success of the transformation will be the acid test for the industry in Germany. We must therefore continue the process and further steps must follow this year in Berlin and Brussels,” Hartmann emphasized.

Coronavirus situation

As described, the already difficult market situation is being significantly worsened by the emerging economic risks of the coronavirus. Dillinger and Saarstahl, like other producers, have curtailed their production. For technical reasons, some of the production areas and equipment – such as the blast furnace and the coking plant – must be kept in a heated and operational state. They are already being operated at the limits of what is technically possible. It is therefore all the more important to ensure orderly operating procedures.

Tim Hartmann explained: “For us, the protection of our employees is of course our top priority. We have been setting up a pandemic working group for several weeks now and have convened a Board-level crisis management team. We continuously inform our employees through our internal communication channels about hygiene-related measures and current developments. We use all available organizational, behavioral and hygienic tools to protect our employees and to minimize the spread of infection.” And he added: “We would like to thank all our employees who, in these dynamic times, are helping cope with this crisis with their courage, determination, prudence and care! We are currently operating according to current conditions, we are responding dynamically and we are confident that we will overcome this crisis, which is likely to continue for some time. At the same time, we must maintain the capacity to act in order to be able to produce steel in the Saar region in the period after the crisis.”

Innovative top-quality steel products, total orientation around our customers' needs and unceasing technological development in close cooperation with our partners form the basis of our success - as they have for more than 333 years.

© 2016 Dillinger All rights reserved.

Contact

AG der Dillinger Hüttenwerke

Werkstraße 1

66763 Dillingen/Saar

Tel.: +49 6831 47 0

Fax: +49 6831 47 2212

E-Mail: info@dillinger.biz

Imprint

| Data privacy statement

| T&C