- News & Information

- Press Releases

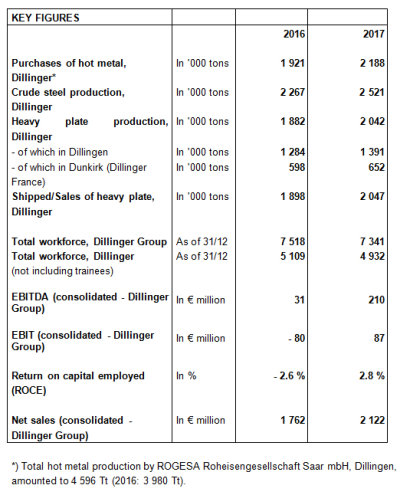

Key figures for the 2017 financial year for the Dillinger Group

10. April 2018

Annual press conference 2018

• Dillinger Group performed well in difficult market conditions.

• Excellent utilization of plant capacities: production at a five-year high

• Consolidated sales rose from € 1.762 billion in previous year to € 2.122 billion

• Dillinger 2020 has produced good results and is being rigorously continued

The Dillinger Group – Aktien-Gesellschaft der Dillinger Hüttenwerke (Dillinger) with its subsidiaries performed well in 2017 – in view of persisting difficult conditions on the heavy plate market. Capacity utilization at the plants was very good across all phases of production. Production significantly exceeded that of the previous year – and thus reached the highest level of the last five years. Shipments also increased significantly.

At the annual press conference, Fred Metzken, Spokesman of the Board of Directors and Chief Financial Officer of Dillinger, said: “We succeeded in increasing volumes and revenues and significantly improved the Group’s sales and earnings figures despite continued massive overcapacities and high import volumes in the heavy plate market.” Projects to reduce costs and increase efficiency and competitiveness as part of Dillinger 2020 contributed significantly here, according to Metzken. “Everyone is pulling together here."

The heavy plate market in Europe remained highly competitive in 2017. Imports, particularly those from China, were significantly reduced on the basis of the European anti-dumping measures introduced in 2016. Other countries increased their volumes, however, so that the level of imports remains high. Overall capacity utilization of European heavy plate manufacturers remained unsatisfactory.

While the heavy plate market in the offshore oil and gas sector continued to weaken due to the slowdown in investment caused by low oil and gas prices, the offshore wind sector and the European large-diameter line pipe market, with its Nordstream 2 and EUGAL projects, experienced a boom in 2017. The price increase for heavy plate that had already begun at the end of 2016 – starting from a very low level – continued in 2017. The primary reason for this was the rise in raw material prices.

Dillinger Group figures for 2017:

-

Production at the rolling mills in Dillingen and Dunkirk, at the wholly owned subsidiary Dillinger France, rose by 8.6 % to 2.042 million metric tons, compared with 1.882 million metric tons in 2016.

-

Consolidated sales revenue improved significantly by 20.4 % to € 2.122 billion (previous year: € 1.762 billion) thanks to an increase in volumes and revenues.

-

Consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to € 210 million (2016: € 31 million) and consolidated earnings before interest and taxes (EBIT) totaled € 87 million (2016: - € 80 million).

-

Investments in the Dillinger Group amounted to € 58 million (2016: € 120 million).

-

Return on capital employed (ROCE) rose to 2.8 % (2016: - 2.6 %).

-

The Dillinger Group's equity and financial structure, at 66.1 %, remains good compared to the industry average.

-

At the end of the financial year, 4,932 people were employed at the Dillingen site (31 Dec. 2016: 5,109). These employees worked at Dillinger itself, at Zentralkokerei Saar GmbH, and at ROGESA Roheisengesellschaft Saar mbH. A total 7,341 people are employed by the Dillinger Group (2016: 7,518).

-

A total of 66 young people began vocational training at Dillinger in 2017 (2016: 80). As a result, the company employed a total of 241 trainees (2016: 236).

Rather subdued prospects for the 2018 financial year

Thanks to good demand, the Dillinger Group started 2018 with high utilization of capacities. For the 2018 financial year as a whole, however, expectations are influenced by the persistently challenging market environment as well as numerous geopolitical uncertainties and are therefore rather subdued. Nevertheless, the Dillinger Group expects capacity utilization to be well above the market average. Continuing problematic framework conditions such as overcapacities and cheap imports make it difficult to raise prices significantly.

The Dillinger Group is consistently pursuing its strategy of further optimizing the product mix. Dillinger sees itself well-positioned for the future with Dillinger 2020, the overarching internal project to secure the long-term future of the site, with the measures the project has introduced as well as its defined fields of action. The aim is to secure technological leadership on a solid and sustainable basis of innovation and thus to ensure the long-term competitiveness of the Dillinger Group. Dillinger 2020 contributes importantly to sustainable cost reductions and thus to increasing earnings.

Subject to possible diversion effects on the European market due to import restrictions in the USA, the Dillinger Group expects sales and earnings figures for 2018 to be at the same level as last year, with slightly lower production and sales volumes.

Innovative top-quality steel products, total orientation around our customers' needs and unceasing technological development in close cooperation with our partners form the basis of our success - as they have for more than 333 years.

© 2016 Dillinger All rights reserved.

Contact

AG der Dillinger Hüttenwerke

Werkstraße 1

66763 Dillingen/Saar

Tel.: +49 6831 47 0

Fax: +49 6831 47 2212

E-Mail: info@dillinger.biz

Imprint

| Data privacy statement

| T&C