- News & Information

- Press Releases

Key figures for the 2016 financial year for the Dillinger Group

21. March 2017

Annual press conference 2017

- As expected, Dillinger Group faced an especially difficult financial year in 2016

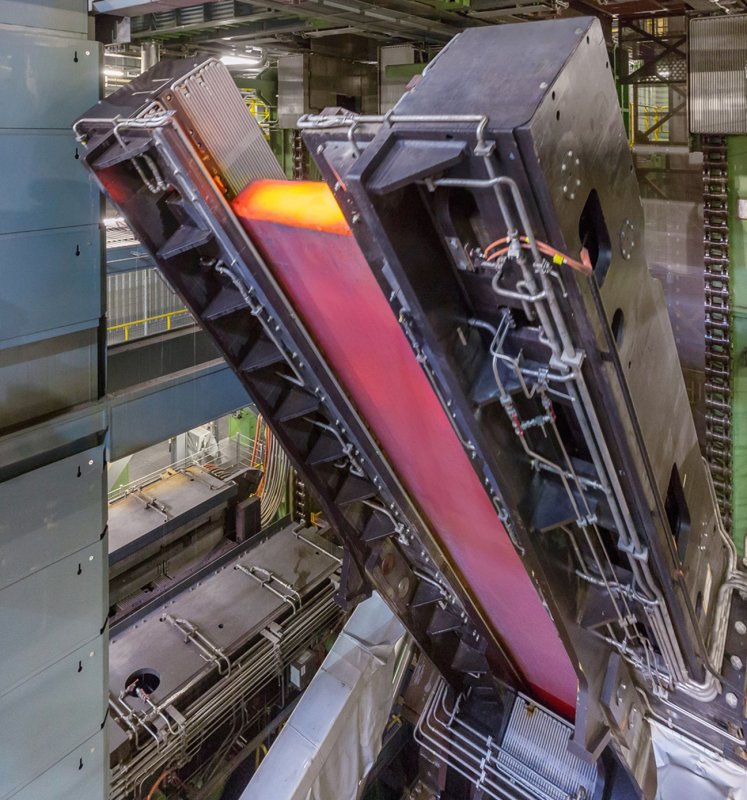

- Good utilization of plant capacities despite relining of blast furnace 4

- Consolidated net sales (€ 1,762 billion) declined from previous year (€ 1,838 billion) due to weak revenue growth

- “Dillinger 2020” agreement to secure company location

The Dillinger Group – Aktien-Gesellschaft der Dillinger Hüttenwerke (Dillinger) together with its subsidiaries – was able to increase its production and sales volumes in 2016 compared to the previous year under challenging economic conditions and despite the three-month relining procedure on blast furnace 4. The heavy plate market remained fiercely competitive in 2016, however, and continued to be characterized by high overcapacities and low revenues. “We were able to post good utilization of plant capacities and higher sales despite a very unfavorable market environment. Nonetheless, our net sales and results came under massive pressure in the extremely competitive heavy plate market, despite sustained cost-cutting measures. Thanks to the “Dillinger 2020” agreement with the Works Council, we will be further consolidating efforts within the company to reduce costs and increase competitiveness, and thus to secure the economic future of the company’s location,” Fred Metzken, Dillinger Board of Management Spokesman, said at the Annual Press Conference.

High overcapacities in the heavy plate market were accompanied by a further 58 % drop in utilization of capacities compared to the previous year at plants in the European Confederation of Iron and Steel Industries (Eurofer). As a result, non-European manufacturers continued the trend of increasing their market shares. Heavy plate steel imports into the EU doubled between 2013 and 2016. The ongoing aggressive predatory competition has led to enormous pressure on revenue and margins. The price increases that set in during the second half of the year were not enough to compensate for the increases in raw material costs that began midyear.

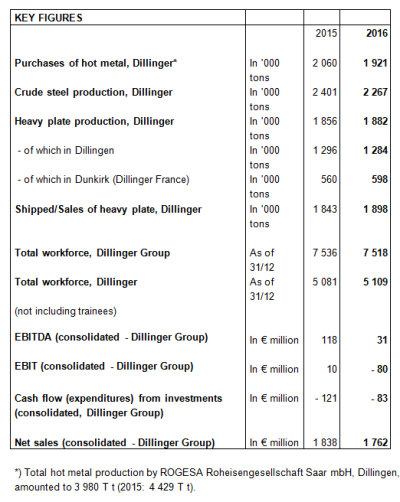

Figures for the Dillinger Group for 2016:

- Production at the rolling mills in Dillingen and at the wholly owned subsidiary Dillinger France in Dunkirk rose to 1,882 million tons, compared to 1,856 million tons in 2015.

- Despite higher sales volumes, consolidated net sales fell due to low revenue levels from € 1,838 billion in the previous year to € 1,762 billion in 2016.

- Consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to € 31 million (2015: € 118 million), and earnings before interest and taxes (EBIT) was - € 80 million (2015: € 10 million).

- The significantly negative earnings are primarily the result of enormous pressure on revenue and margins and higher expenses.

- In 2016, payments by the Dillinger Group to continue investment measures in fixed assets amounted to € 120 million (previous year: € 154 million).

- Despite the high investment spending, the equity ratio was 66 % of the balance sheet total.

- The focus of investments at Dillinger itself (€ 69 million) was the

new continuous casting machine CC 6, which began operation in 2016 and with which the company wants to secure its technological advantage and develop an increasingly advanced product mix. - A total of 5 109 people were employed at the Dillingen plant at the end of the financial year (31 Dec. 2015: 5 081). These employees worked at Dillinger itself, at Zentralkokerei Saar GmbH, and at ROGESA Roheisengesellschaft Saar mbH.

A total 7 518 people are employed by the Dillinger Group (2015: 7 536). - A total of 80 young people began vocational training at Dillinger in 2016 (2015: 65). As a result, the company employed a total of 236 trainees when all training class years are included.

Subdued prospects for 2017 with continuing problematic market conditions

Because of the current underlying conditions in the heavy plate market, no fundamental improvements in prospects for 2017 are expected. The ongoing structural crisis, characterized by overcapacities and steadily growing volumes of cheap imported materials, will continue to define price competition among suppliers in Europe.

It is therefore absolutely essential that politicians enact reasonable and sustainable trade and climate policies for the future. Short decision paths for introducing antidumping measures, fair market practices and comparable statutory requirements to reduce CO2 are essential to prevent the risk of deindustrialization of Western Europe.

Thanks to overall good demand from important consumer segments such as steel construction, machine manufacturing and offshore wind power, the Dillinger Group started the year with good utilization of capacities that considerably exceeded the market average. Initial price increases were achieved at the start of 2017, but due to project business, the effects are only noticeable starting from the second quarter. Thanks to higher production and sales volumes as well as the associated price adjustments, the Dillinger Group expects an overall increase in net sales in 2017.

Efforts for strict cost-cutting and to increase efficiency and competitiveness continue to be imperative. The Board of Management and Works Council of Dillinger have concluded the “Dillinger 2020” agreement aimed at securing the long-term economic future of the company’s location. Provided that these additional measures to increase profitability and competitiveness prove effective and that market conditions recover somewhat – also in connection with the market mechanisms introduced by public policymakers – a considerable improvement in sales and earnings figures is expected for 2017.

Innovative top-quality steel products, total orientation around our customers' needs and unceasing technological development in close cooperation with our partners form the basis of our success - as they have for more than 333 years.

© 2016 Dillinger All rights reserved.

Contact

AG der Dillinger Hüttenwerke

Werkstraße 1

66763 Dillingen/Saar

Tel.: +49 6831 47 0

Fax: +49 6831 47 2212

E-Mail: info@dillinger.biz

Imprint

| Data privacy statement

| T&C