- News & Information

- Press Releases

Crisis has a delayed impact: Dillinger Hütte Group remains in the black despite significant declines in revenues and earnings

22. April 2010

Sharp decline in consolidated revenues to €2.3 billion; consolidated EBIT (€131 million) and EBITDA (€232 million) remain positive Early introduction of measures to adjust utilization of capacities and stabilize earnings Dr. Belche, Chairman of the Board of Management: “The year 2009 was one of contrasts: after a good start, Dillinger Hütte experienced a delayed impact from the crisis.”

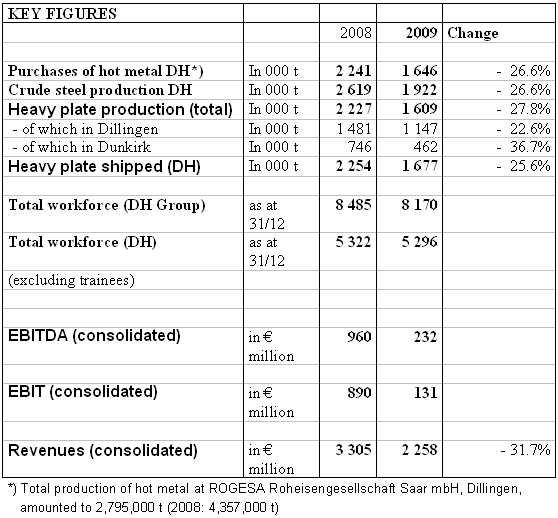

The 2009 financial year was a year of contrasts for the Dillinger Hütte Group (Dillinger Hütte and its subsidiaries): while there was still good utilization of production capacities at the beginning of the year, a massive reduction in demand that began in the second quarter led to significant declines in revenues and earnings. Dillinger Hütte Group posted consolidated revenues of about €2.3 billion (2008: €3.3 billion). Consolidated earnings before interest, taxes, depreciation and amortization (consolidated EBITDA) declined to €232 million (2008: €960 million), and earnings before interest and taxes (EBIT) declined to €131 million (2008: €890 million). “The crisis had a delayed but strong impact on us,” said Dr. Paul Belche, Chairman of the Board of Management, at the company’s annual press conference. “We reacted to the crisis quickly and at an early stage, starting in late 2008, and introduced a multitude of measures to adjust production and stabilize earnings.”

Delayed downward trend on the heavy plate market

The financial crisis first impacted the heavy plate market, which is characterized by project-related business, at the end of the first quarter of 2009, affecting all products. While the prices for commodities slipped significantly in the third quarter of 2008, prices for higher-value products first came under pressure in early 2009, since the specialized mills still had a backlog of orders from the previous year. During the course of 2009, heavy plate manufacturers were forced to absorb massive slumps in deliveries for all important customer segments.

Sharply reduced utilization of plant capacities – revenues down significantly

In accordance with conditions on the heavy plate market, Dillinger Hütte continued to produce at a good level until the end of the first quarter of 2009. The massive slump in incoming customer orders forced utilization of plant capacities to be reduced beginning in the second quarter. Blast Furnace 4 of ROGESA Roheisengesellschaft Saar mbH was shut down earlier as planned for repairs from May to October, the steel mill was run as a single-converter operation for several months, the number of shifts was reduced in all areas of production and production stops were carried out.

Production at the rolling mills in Dillingen and at the wholly owned subsidiary GTS Industries

S. A. in Dunkirk, France, reached 1.609 million tons, compared with the very high level of 2.227 million tons in the previous year. In all, Dillinger Hütte shipped 1.677 million tons of heavy plate (2008: 2.254 million). Consolidated revenues, at €2.258 billion, remained significantly below the record revenues of the previous year (€3.3 billion) due to the decline in quantities and revenue levels.

Positive earnings despite significant declines

Dillinger Hütte and its subsidiaries experienced a significant decline in earnings compared to the record earnings of the previous year. Consolidated earnings before interest & taxes (EBIT) amounted to €131 million (2008: €890 million) and consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) was €232 million (2008: €960 million). Consolidated return on sales (EBIT margin) amounted to 5.8% (2008: 26.9%) and the return on capital employed (ROCE) was 4.4 % (2008: 34.5%).

Staffing levels roughly constant – adjustments to weak utilization of capacities

In order to react flexibly to weak utilization of capacities, traditional staffing instruments began being implemented at the start of the year, including reduction of time accounts, intensive use of personal leave, avoidance of overtime, reductions in employment of students during their vacation periods and of temporary employees, and reduced use of outside firms. These measures were sufficient only for the initial months; short time working ultimately had to be introduced in many of Dillinger Hütte’s operational sections, from June 1, 2009 until early 2010.

The total workforce at the Dillingen site remained roughly consistent with that of the previous year, with 5 296 employees at year’s end (Dec. 31, 2008: 5 322 employees). These employees worked at Dillinger Hütte itself, at Zentralkokerei Saar GmbH (ZKS) and at ROGESA Roheisengesellschaft Saar mbH (ROGESA). A total of 8 170 employees are employed within the Dillinger Hütte Group (2008: 8 485).

Investment activity remains high

Investment in optimization and modernization of processes and facilities remained at a high level (€56 million) during the economically difficult 2009 financial year, even if expenditures did decline in comparison to the higher-than-average investments of the previous year (2008: €122 million). At both direct subsidiaries – ROGESA Roheisengesellschaft Saar mbH and Zentralkokerei Saar GmbH at the Dillingen site – investment expenditures increased once again in comparison to the previous year to a total of €131 million (2008: €111 million). Dillinger Hütte bore half of these investment costs, in proportion to its share in the companies. These sums are part of an ongoing investment program that began in 2007 and will continue through to 2011, with a total of approximately €530 million going to strengthen the Dillingen location for the future.

A difficult year 2010 for Dillinger Hütte

Dillinger Hütte Group expects to experience a difficult year 2010 in comparison with 2009. Compared with the beginning of the previous year, the first months of 2010 have been marked by a significantly lower order backlog and weak revenue levels. Moreover, in contrast to the previous year, the very high orders for tube plate from EUROPIPE are lacking.

Nevertheless, plant capacities were once again being utilized at normal levels at the beginning of the year, unlike the second half of 2009. This is explained by the booking of larger quantities for the second strand of the Nord Stream Pipeline and the limited availability of capacities in 2010 due to the upcoming relining of ROGESA’s Blast Furnace 5 and the accompanying 100-day shutdown. Dillinger Hütte was able to implement the first price increases starting with the middle of the first quarter of 2010. It must be assumed, however, that the prices will have to be further increased in order to compensate for foreseeable significant increases in raw materials costs.

Due to the fragile underlying economic conditions and the unfavorable market environment, which has a delayed impact on the the late-cycle heavy plate segment, as well as to the relatively low prices in both core product groups – tube plate and normal plate – the Dillinger Hütte Group expects a decline in revenues and financial results for 2010. Dillinger Hütte continues to emphasize its balanced and highly specialized product mix, and has introduced numerous measures to improve earnings and optimize costs. Accordingly, balanced earnings are still expected from a difficult year 2010.

Innovative top-quality steel products, total orientation around our customers' needs and unceasing technological development in close cooperation with our partners form the basis of our success - as they have for more than 333 years.

© 2016 Dillinger All rights reserved.

Contact

AG der Dillinger Hüttenwerke

Werkstraße 1

66763 Dillingen/Saar

Tel.: +49 6831 47 0

Fax: +49 6831 47 2212

E-Mail: info@dillinger.biz

Imprint

| Data privacy statement

| T&C